When it comes to saving for retirement, many individuals opt for a traditional 401(k) plan offered by their employer. While these retirement plans can be a great way to save for the future, they often come with limited investment options and high fees. Fortunately, there is another option available — the self-directed 401(k).

Below, we’ll cover what a self-directed 401(k) is, the advantages of choosing this type of plan, how contributions work, and additional ways you can use this retirement account to enhance your financial future.

What Is a Self-Directed 401(k)?

A self-directed 401(k), also referred to as an individual 401(k), solo 401(k), self-employed 401(k), or solo(k), is a retirement account tailored for businesses that solely employ the owner, their spouse, and business partners.

Self-directed 401(k)s are ideal for self-employed individuals, corporations, incorporated and unincorporated businesses, partnerships, and sole proprietorships. Requirements for qualified contributions to a solo 401(k) are simply that the contributor receives a salary or wage. The small business must also not have any additional staff or employees other than the spouse of the plan holder or the business’s partners. Meeting the IRS-mandated qualifications offers high 401(k) contribution limits along with the possibility of tax deductions.

Benefits of a Self-Directed 401(k)

Some benefits of opening a self-directed 401(k) with Accuplan include:

- More control over investment decisions: A self-directed 401(k) allows you to invest in a broader range of retirement assets than traditional 401(k) plans, giving you more control over your investment decisions.

- Diversification: Investing in alternative assets through a self-directed 401(k) can provide opportunities for diversification, which can help mitigate risk in your portfolio. You can invest in real estate, personal loans, private equity, and more.

- Tax advantages: Self-directed 401(k) plans offer the same tax advantages as traditional 401(k) plans, such as tax-deferred growth and potential tax deductions for contributions. Additionally, investing in certain assets, such as real estate or precious metals, may offer additional tax benefits.

- Potential for higher returns: Some alternative assets, such as real estate or private equity, may offer higher potential returns than traditional stocks and bonds. Investing in these assets through a self-directed 401(k) may provide the opportunity for higher returns in the long run.

- Flexibility: Self-directed 401(k) plans can be customized to fit your unique investment goals and risk tolerance.

How Solo 401(k) Contributions Work

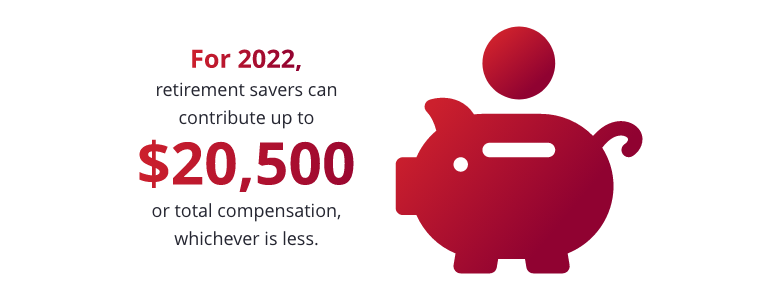

When operating a solo 401(k), the contributor essentially has two job titles — the employee and the employer. Contributions can be made on behalf of both roles, so the 401(k) owner can contribute:

- Elective contributions: Up to 100% of compensation, up to the set limit of $22,500 for 2023 or $30,000 for individuals age 50 or older.

- Nonelective employer contributions: Up to 25% of compensation.

Contributions for Self-Employed Individuals

As a self-employed individual, you need to perform a special calculation to determine the maximum amount of nonelective contributions and elective deferrals you can make.

Your total contribution amount cannot exceed your net self-employment income for the year after you deduct your contributions and half of your self-employment tax. Contributions to a solo 401(k) plan can be made up until the tax filing deadline, including extensions.

How Accuplan Improves A Self-Directed 401(k)?

Accuplan Benefits Services offers diverse self-directed 401(k) investment options, allowing you to venture beyond traditional stocks and bonds. With us as your provider, you can explore investments in tangible assets like real estate and precious metals, as well as in paper assets such as personal loans and private equity. Take charge of your retirement funds with a self-directed account and invest in assets that align with your financial goals.

Using a Self-Directed 401(k) to Purchase Real Estate

One of the significant advantages of a self-directed 401(k) is the ability to invest in real estate. This can include purchasing investment property to generate rental income. Real estate can be a stable and potentially lucrative investment, providing a hedge against inflation and offering the possibility of long-term appreciation.

How to Start a Solo 401(k)

Starting a solo 401(k) plan is a relatively straightforward process. Follow the steps below to learn how to set up a self-directed solo 401(k):

- Check eligibility: Solo 401(k) plans are available to self-employed individuals or small business owners with no employees, except for a spouse. Make sure you meet the eligibility requirements before proceeding.

- Set up the plan: Once you have chosen a self-directed 401(k) custodian, you will need to set up the plan. This typically involves completing an application and providing some basic information about your business.

- Fund the plan: Once the plan is set up, you can fund it by making contributions.

- Choose investments: With a solo 401(k) plan, you have the option to choose your own investments, so it’s important to carefully consider your investment strategy and select alternative investments that align with your goals and risk tolerance.

Frequently Asked Questions

Below are some frequently asked questions we received regarding self-directed 401(k)s and solo 401(k)s.

Self-directed 401(k) investment options cover a wide variety of tangible assets. Real estate is one of the most popular assets that Accuplan’s clients invest in. We also see investments in cryptocurrency, tax liens and private equity. The list of the IRS’ 401(k) prohibited transactions is much shorter.

You may not have heard of a self-directed 401(k) before because:

- Big-name custodians or brokerages don’t understand alternative assets and find them bothersome.

- They don’t make money off offering these assets. They’re mainly interested in commissions to be earned off mutual funds or bonds.

- There are only a handful of actual full-service self-employed 401(k) providers.

Accuplan Benefits Services has streamlined our process for opening an alternative investing account. Our application takes just minutes and our knowledgeable staff processes each application, rollover, transfer or request within minutes of receiving them. Get in contact with one of our experts, and start investing in alternative assets today.

Yes, an account holder can contribute to a 401(k) and an IRA plan, but it’s important to note that the contributions made to the IRA might not be fully tax-deductible since contributions are also being made to the solo 401(k). The deciding factor will be the account holder’s AGI, which determines eligibility to deduct the IRA contributions.

Open a Self-Directed 401(k) With Accuplan

A self-directed 401(k) can be a powerful tool for taking control of your retirement savings and investing in a wider range of assets. At Accuplan, we specialize in self-directed retirement accounts, including self-directed 401(k)s. We offer a variety of investment options, including real estate, private equity and precious metals. Additionally, we provide administrative support for your self-directed 401(k) plan, including record-keeping and tax reporting. Open a self-directed 401(k) with us at Accuplan today.