Opening a self-directed IRA (SDIRA) unlocks multiple retirement investment options for you beyond the basic stocks, mutual funds and bonds. SDIRAs offer the same tax advantages as standard IRAs, with the added benefit of greater portfolio diversification.

One of the ways your self-directed IRA can help you build a nest egg is through loans because you can lend money from your SDIRA. Learn more about how lending with IRA money works, the rules for self-directed IRA lending, and if a self-directed IRA can borrow money.

Understanding Self-Directed IRA Loans

Self-directed IRAs (SDIRAs) can issue loans, turning the retirement accounts into miniature banks. The amount you can lend to others is limited to the amount in the account, but otherwise, there aren’t any minimum balance requirements. You can start lending from your SDIRA if you have $1,000 in the account or $100,000.

You control the lending process when you use your SDIRA to issue loans and you become in charge of choosing the people or companies you’ll loan money to, although there are some restrictions.

When your self-directed IRA makes loans, you establish the following:

- Loan amount

- Interest rate

- Loan term

- Payment terms and amount

- Type of loan

What Is a Self-Directed IRA Loan?

A self-directed IRA loan is an established amount made up of funds in your self-directed IRA that you may lend to a borrower so long as they pay the amount back according to your terms. It is important to ensure the self-directed IRA only lends to people the IRS does not consider a disqualified person. These are people the IRS specifically prohibits from receiving money from your IRA.

One of the easiest ways to take out a short-term personal loan is to take advantage of the 60-day rollover rule loophole. This may be ideal if the intended recipient only needs the money for a short time and can redeposit the amount within the next 60 days. You may only make one rollover within a one-year period.

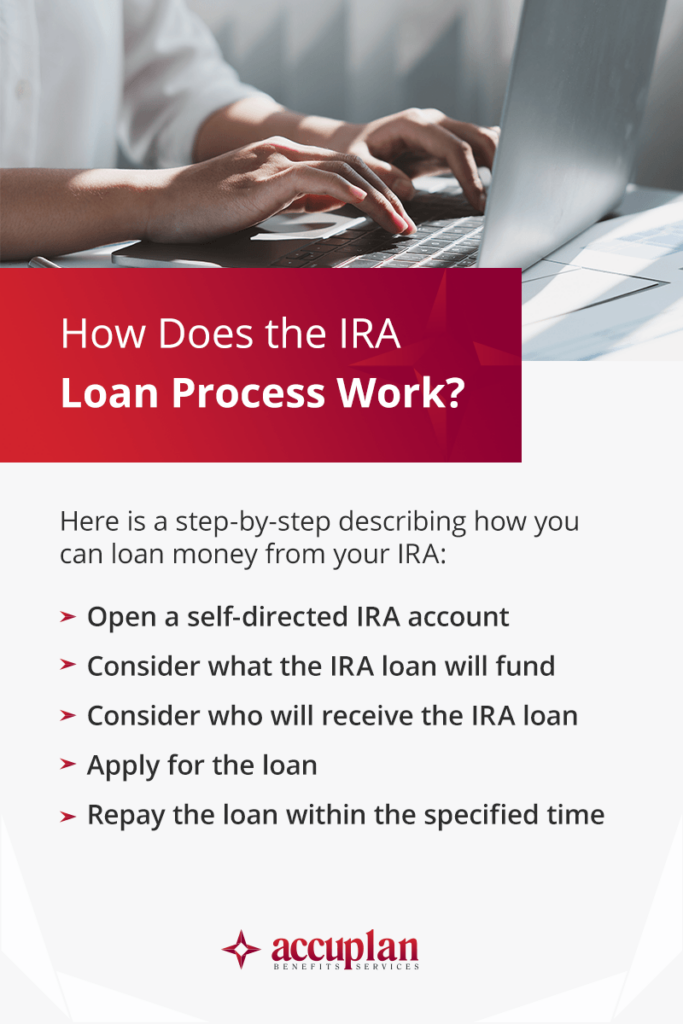

How Does the IRA Loan Process Work?

Here is a step-by-step describing how you can loan money from your IRA:

- Open a self-directed IRA account: If you have yet to open an account, you may start by finding your ideal custodian and self-directed IRA account, establishing your account and funding it via transfer from an existing retirement account or direct contributions.

- Consider what the IRA loan will fund: The IRS prohibits using IRA funds on particular investments. For example, you may be unable to use IRA loan funds on collectibles or life insurance.

- Consider who will receive the IRA loan: Avoid lending to disqualified persons such as yourself, certain family members and any business owned by yourself or your family members.

- Apply for the loan: After you are sure the IRA loan is compliant with IRS rules, you may instruct your custodian to complete the transaction for you. Make sure that all terms of the loan are clear and understood.

- Repay the loan within the specified time: If you opted for the 60-day rollover rule loophole, ensure the full loan is repaid within 60 days to avoid the early withdrawal penalty and income tax.

Lending From a Self-Directed IRA

Lending is an excellent perk of self-directed IRAs. Still, it may be helpful to understand the type of loans you may take and the benefits and risks of doing so.

Can My Self-Directed IRA Lend Money to Others?

You can lend money from your SDIRA to others, with some exceptions. Under IRS rules, the self-directed IRA can’t lend to any disqualified persons. These may include:

- IRA holder

- IRA holder’s spouse

- Relatives and spouses of immediate relatives

- Fiduciaries of the plan

- An entity owned by disqualified persons

Otherwise, you can choose who to lend to, whether it’s a stranger from the internet, a startup looking for funding or a close friend who needs money.

The IRS specifies that the maximum amount you can loan to someone from your retirement account may be $50,000 or the greater of $10,000 or 50% of your account balance, depending on which is less.

You have a say over the type of loans your SDIRA will make. You can choose to offer unsecured loans, meaning there isn’t any collateral behind the loan. With an unsecured loan, there’s no protection for the SDIRA if the borrower can’t repay, but you might charge a higher interest rate.

Secured loans have collateral behind them, such as a car or another piece of property. If your SDIRA is large enough, you might be able to use it to issue mortgages to borrowers. If the borrower stops paying back the secured loan, your self-directed IRA has the right to seize the collateral. You can then sell the collateral to recoup some or all of your losses.

When lending money through your self-directed IRA, you may issue an unsecured or secured promissory note, deed of trust or mortgage, which the borrower should sign along with other loan documents. Lending money can help you build wealth through interest rates and tax benefits.

Remember that all loan documents should be in the IRA’s name and that you may only access any gains once you are retired since the IRS prohibits IRA holders from benefiting from their IRA funds until after retirement.

Benefits of Lending From an SDIRA

The most significant benefit of lending money from your self-directed IRA is enjoying a decent return on investment (ROI). Your ROI depends on several factors, a few of which you can control. The loan length, the amount borrowed and the interest rate all influence the ROI. The higher the interest rate and the longer a borrower needs to repay the loan, the more you can earn.

You might also feel good about using your SDIRA to lend money, especially if you lend to borrowers who have limited loan options. Plus, you get all the tax advantages connected to an IRA and can enjoy the benefit of further diversifying your retirement portfolio.

Risks of Lending from an SDIRA

Any investment has risks, including lending from an SDIRA. One of the most significant risks is that you could lose your money. If you make an unsecured loan to a borrower who then stops paying it, you can lose the principal amount, plus any interest the SDIRA would have earned.

You can reduce risk by performing due diligence before making the loan. Ask for an application, check the borrower’s credit history and check references. You want to lend to borrowers with the highest chance of repaying the debt.

Additionally, if you lose compliance by holding private notes with a disqualified person or engaging in a prohibited transaction, you may receive penalties and potentially disqualify your IRA. These risks mean it’s essential to thoroughly assess the transaction and IRA rules to ensure you avoid noncompliance. Similarly, you should do your research to ensure whether the market will still be in demand when you retire so that it is easier to sell your private notes and access funds.

Borrowing With a Self-Directed IRA

Let’s explore the situations in which borrowing is allowed with a self-directed IRA.

Can I Borrow Money From My Self-Directed IRA?

While you cannot borrow money from your self-directed IRA as a disqualified person, you can use the 60-day rollover rule to borrow funds from your self-directed IRA as long as you repay the amount.

Can a Self-Directed IRA Borrow Money?

You may be wondering if a self-directed IRA can borrow money. The short answer is yes, you can also use your self-directed IRA to borrow money, mainly if you’re using the SDIRA to invest in real estate. You can apply for a non-recourse loan in the SDIRA’s name. The property the SDIRA purchases acts as the collateral on the loan.

An important thing to know about getting a non-recourse loan through your SDIRA is that the lender can only go after the SDIRA, not you if the loan defaults. The lender can seize your SDIRA but can’t try to seize any other investment property or assets owned by you.

Non-Recourse Loans for Self-Directed IRAs

Non-recourse loans are secured by the investment, and the real estate purchased with your IRA becomes the collateral. By doing so, if there is a default, the lender may only pursue that asset rather than your personal savings and other assets. These loans typically have higher interest rates and specific eligibility requirements due to the higher financial risk they pose to lenders.

For example, some lenders may require a higher percentage of the property value and investment properties with stronger income potential. This helps lenders ensure the property will generate enough income to repay the loan.

Additionally, you may need to seek out a specialized IRA non-recourse real estate lender to ensure they understand the requirements of this loan. For example, a regular non-recourse lender might ask you to sign a personal guarantee. In contrast, an IRA non-recourse lender should understand that the loan is in the IRA’s name and that if you were to sign it, it would become a prohibited transaction.

Can You Use an IRA as Collateral for a Loan?

Yes, you may use your IRA as collateral when you take on a non-recourse loan. While this offers a great way to protect assets and investments outside of your IRA, there are some legal and financial implications to be aware of. For example, non-recourse loans may incur unrelated business income tax (UBIT), otherwise called unrelated debt-financed income (UDFI) tax, which is specific to self-directed IRA non-recourse loans when acquiring real estate.

It may help to speak with a tax advisor about how the UDFI tax may impact your unique situation. This may allow you to plan and optimize your investment strategy accordingly. Other fees worth considering are the closing costs, which must come from the IRA funds since the IRA itself is the borrower. Transaction fees may also need to come from your IRA to purchase the loan and investment.

Other Factors for Self-Directed IRAs Borrowing Money

Another important part of self-directed IRAs borrowing money is that the IRS regulations state the debt must be “non-recourse.” This means that the IRA owner doesn’t have a personal guarantee on it.

Most Important Self-Directed IRA Loan Rules

Before you start lending from a self-directed IRA, there are a few important rules to know before you start:

- Due diligence: The first rule is to do due diligence before lending to anyone. Your SDIRA provider or custodian will not do this for you. It’s in your best interest to vet any potential borrowers and set the loan terms based on the information you uncover.

- Disqualified persons: The second rule concerns disqualified persons or who you can and can’t lend money. If the borrower is related to you or has a business connection to you, you can feel confident that the IRS considers them disqualified.

- Lending activity: All lending activity comes from the self-directed IRA. You and your SDIRA are entirely separate entities. Any money you lend comes from the IRA. If you contribute $1,000 to your SDIRA and then lend it to someone, you need to deposit the money first. It also means that any profits, such as interest earned, need to go back into the SDIRA. The borrower should make payments in the name of the self-directed IRA, not your name.

If you are borrowing with your self-directed IRA to purchase real estate, there are a few more rules to note. You can’t use your SDIRA to buy a home to live in. Similarly, you can’t buy a house for your brother or children using a non-recourse loan or any funds from your SDIRA.

FAQs on Self-Directed IRA Loans

Here are a few more commonly asked questions about borrowing and lending with self-directed IRA loans.

Can I Borrow Money From My IRA to Buy a House?

You may use your self-directed IRA to buy a house, although there are certain rules to follow. For instance, you and other disqualified persons cannot live on this property, as the IRS prohibits disqualified members from personally benefiting from IRA funds at the current time before your retirement.

For this reason, it’s best to buy a house with IRA funds only for investment purposes with non-disqualified persons. You may then invest in various types of real estate, such as apartments, parking lots, boat slips, multifamily buildings and mobile homes.

Can I Loan Myself Money From My Self-Directed IRA?

Generally, the IRS prohibits IRA account holders and their affiliated entities from lending money to themselves from their self-directed IRA. Retirement plans like the 401(k) might allow you to take out a loan without tax consequences if you follow the IRS rules and the repayment schedule. Otherwise, if you are facing an immediate and significant financial hardship, you may be able to withdraw an amount early. You won’t need to repay this amount, but you will pay taxes on it.

How Much Can I Borrow From My IRA?

Since the IRS prohibits account holders from lending money to themselves from their self-directed IRA, you may not borrow any money from your IRA for personal use because you are a disqualified person. While you may be able to “borrow” money through the 60-day rollover rule, they do not specify an amount, so it may help to speak with an IRA professional about an appropriate amount.

Contact Accuplan to Learn More About Self-Directed IRA Lending

Accuplan has been providing self-directed IRAs since 2007. If you want to diversify your portfolio while enjoying the tax benefits of an IRA, we can help you get started. In addition to using a self-directed IRA to lend money or purchase real estate, you can decide to invest in cryptocurrency, precious metals and many other assets.

We’ve made it easy to open an account and get started. If you have any questions about self-directed IRAs or using your SDIRA to lend money, contact us today.

This information shouldn’t be relied upon for investment advice but is for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.