Can self-directed IRAs invest in private equity funds? The answer is yes, but you need to know some essential things. Combining private equity investments and self-directed IRAs provides a unique investment opportunity for individuals seeking comprehensive investment options with a high degree of control. However, there are rules.

In this guide, you’ll learn about private equity investment with self-directed IRAs, including how they work, the types of benefits, the advantages of these arrangements and tips on investing.

What Is Private Equity Investment?

Private equity investment or private placement involves the ownership interest in companies not publicly traded on a stock exchange. In other words, it’s a type of investment focusing on privately held entities, from small businesses to big corporations.

What Are Self-Directed IRAs?

A self-directed individual retirement account (SDIRA) is an individual retirement account (IRA) capable of holding alternative investments in addition to conventional investment options. It is directly managed by the account holder, although administered by a custodian.

What Is Private Equity Investment With Self-Directed IRAs?

Private equity investment with a self-directed IRA focuses on privately owned assets in businesses. The account holder controls the portfolio and can invest directly in a company or through a pooled investment vehicle or fund.

Investing directly in a company means putting money into private businesses and receiving equity interests, such as common or preferred shares. Investing through a pooled investment vehicle may include investing in private equity funds, funds of funds and venture capital funds.

The unique characteristic of this arrangement is the account holder’s level of control. You can choose the preferred investment with limited restrictions. This option lets you rely on your knowledge and experience or guidance from a trained professional to make informed decisions.

Important Private Placement Investment Considerations

Here are two essential factors to consider about private placements with self-directed IRAs:

- Securities and Exchange Commission requirements: Private placements are typically exempt from Securities and Exchange Commission (SEC) registration and reporting requirements. However, investors must be accredited for risk management purposes.

- Due diligence: It’s vital to do your due diligence before investing in a private placement to reduce associated risks such as fraud.

What Are the Rules for Investing in Private Placement With Self-Directed IRAs?

Private placements with self-directed IRAs are guided by rules, including:

- Your IRA cannot purchase any private stock that you already own.

- Neither you nor any disqualified persons can be employed by the company while the IRA holds an equity position.

- All investment earnings must fall into the self-directed IRA account.

- Earnings from the entity may be subject to Unrelated Business Income Tax (UBIT).

- The IRA is the owner of the private equity and not the holder of the IRA. Because of this, the IRA account must pay all relevant fees and costs and all the gains return to the IRA account.

- Legal documents must be in the name of the IRA and not your personal name.

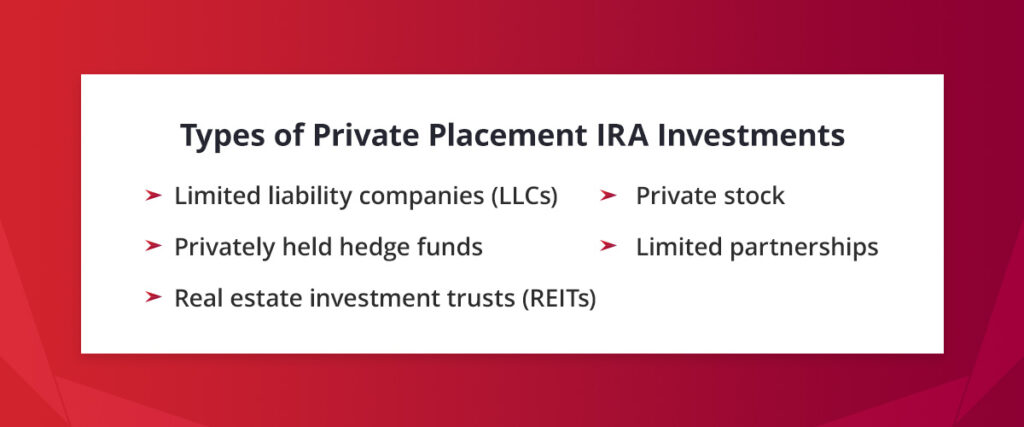

Types of Private Placement IRA Investments

There are different types of private equity investments, such as:

- Private stock: Shares in a private business not traded on the public exchange. Private stock is primarily held by private equity firms, venture capitalists and founders or shareholders of companies.

- Privately held hedge funds: Private pooled investment vehicle that allows a group of investors to pool funds to pursue investments with greater purchasing power.

- Limited partnerships: A business arrangement involving two or more partners, where debt and liability are limited to the share of investment.

- Limited liability companies (LLCs): Business structures that combine the elements of partnership and corporations, allowing you to invest without assuming personal liability for the company debts, subject to legal exceptions. Profits go through to the owners and are taxed as individuals on their share of the LLC’s taxable income.

- Real estate investment trusts (REITs): A company that owns or operates income-producing real estate. While non-traded REITs are required to register with the SEC, private REITs are not.

Other types of private equity investment avenues include:

- Small businesses

- Startups

- Partnerships

- Corporations

- Equity crowdfunding

- Convertible notes

- Franchises

- Land trusts

What Are the Benefits of Private Equity Investing in an IRA?

Private equity investments with self-directed IRAs offer many benefits, including:

- Control and flexibility: Self-directed IRAs allow the account holder greater control and flexibility over investment decisions. You can actively choose private placement options that align with your investment goals and risk tolerance.

- Active involvement: Some private equity investments may provide opportunities for active participation in the decision-making process. This arrangement appeals to individuals seeking a hands-on approach to their investments.

- Diversification: Private placements provide diversification within your self-directed IRA portfolio. You can invest in private companies, real estate and other non-publicly traded assets, reducing the correlation between your investments.

- Access to alternative investments: Private placements provide opportunities to invest in sectors and strategies excluded from traditional investments. Classic examples include venture capital and infrastructure projects.

- Potentially higher returns: Private placements have the potential to generate higher returns than traditional assets like stocks and bonds. Most private businesses experience significant growth, and investing in them can result in substantial profits if they succeed. Plus, there are fewer administrative and associated costs.

- Tax advantages: A self-directed IRA has added tax advantages. Traditional self-directed IRAs provide tax-deferred growth, meaning you pay taxes when you withdraw the funds during retirement. Roth self-directed IRAs offer tax-free growth, meaning qualified withdrawals are tax-free.

- Long-term focus: Private placements span several years, aligning with most people’s retirement saving goals. The long-term focus allows you to benefit from compounding growth over time.

How to Invest in a Private Placement With a Self-Directed IRA

Here are three steps for investing in a private placement with a self-directed IRA:

- Create a self-directed IRA with a reliable custodian.

- Roll over funds from retirement plans such as a 401(k) or 403(b) or transfer funds from an existing IRA.

- Instruct your self-directed IRA custodian to invest in your preferred private equity investment.

Things To Do Before Investing in Private Equity With Self-Directed IRAs

Complete these four things before investing in a private equity IRA:

- Identify your investment objectives and risk tolerance: List your investment objectives and assess your risk tolerance before investing. There are many options with varying risk levels, so it’s crucial to choose the one that best suits your needs.

- Conduct research and due diligence: Examine the potential investment opportunities, considering the company’s background and performance, legal and regulatory compliance, and terms of the investment contract.

- Seek professional advice: Financial, tax and legal professionals can provide valuable insight into complex private placement options to help you make informed decisions. They can assist with due diligence and developing strategies to optimize your investments.

- Choose an experienced custodian: Experienced IRA custodians for private placements can offer professional guidance and helpful tips on managing your assets to yield the best possible results.

Accuplan: Your IRA Custodian for Private Placements

Accuplan Benefits Services assists individuals and businesses with investing in self-directed IRAs. Our team has vast industry knowledge with experience spanning nearly 20 years. We are dedicated to providing practical solutions to help clients maximize their returns. Do you want to learn more about our offerings? Contact us today!

You Might Also Like

Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.