Self-directed IRAs have been around for a long time, and their increasing popularity has grown over time, especially among those who like a lot more control of their financial future. A self-directed IRA provides diversification of assets for everyone from the average Joe to investors looking to expand beyond stocks, bonds and treasuries.

Self-Directed IRA Basics

A self-directed individual retirement account (IRA) requires a custodian to hold your retirement money in the account and make investments for you in alternative assets like real estate, precious metals and private placements at your request. Self-directed accounts require more responsibility from you, meaning you have to understand all the rules governing any particular investment and the tax implications and you are responsible for your own due diligence when selecting investments.

For more complex investments, especially if you are opening a new account with an entity other than a well-recognized broker or traditional financial institution, you may want to get a second opinion from an unbiased professional, such as an attorney or a licensed investment professional, rather than set up the account yourself.

Traditional Self-Directed IRAs

When learning how to set up a self-directed IRA, it’s best to know how they work and decide if it’s a good fit. Get familiar with all their characteristics and requirements, including:

- Contributions: Each year, you can contribute $7,000 to your IRA, plus an additional $1,000 for catch-up contribution if you have reached age 50 or older.

- Taxes: You are potentially eligible to deduct Traditional IRA contributions and subsequently get a tax break for the year you make the contribution. To receive that tax break, you must meet certain requirements. You must be 18 or older, not a student and not claimed as a dependent on someone else’s tax return. Your adjusted gross income on your Form 1040 series return will determine whether you receive a credit of 10%, 20% or 50% of your IRA contributions.

- Age limits: You can contribute to your Traditional IRA until you reach the age of 70.5.

- Income limits: There are no limits to contributions based on your income.

- RMDs: Traditional IRAs are subject to required minimum distributions (RMDs). You must begin to take distributions by April 1 of the year after you reach age 70.5 if you were born before July 1, 1949, regardless of whether you need the funds. Note that the SECURE Act, signed in 2019, dictates that you don’t have to take distributions until you reach 72 if your 70th birthday was on July 1, 2019, or later.

- Penalties: Traditional IRA contributions are generally treated as ordinary income and are subject to income taxes. If you withdraw from your IRA before age 59.5, you may be subject to early-distribution penalties that can be up to 10% in penalty tax. There are some exceptions to this tax penalty, such as withdrawing money to pay a medical insurance premium after losing your job or becoming totally and permanently disabled.

Self-Directed IRA Investments Are Not Guaranteed

Like any and every investment, there’s no such thing as a “sure thing.” While it’s unfortunate that there’s no guarantee, that doesn’t mean you should avoid investments — it just means that you, as the investor, should tread lightly.

Consulting with a seasoned and qualified provider, conducting due diligence and research into an investment beforehand and keeping a pulse on technology, like apps, startups and gadgets, are your best bets for secure investments.

How to Open a Self-Directed IRA

Considering the potential benefits you may get from opening a self-directed account, following a particular set of steps may help increase your chances of selecting a reputable custodian and reliable self-directed IRA account.

1. Choosing Administrators and Custodians

Knowing where you can get a self-directed IRA will streamline the rest of the process if you choose the right partner. You’ll need to find a brokerage firm or custodian that accommodates self-directed retirement accounts — for example, Accuplan — to create an account and begin contributing money.

When you choose us, you can enjoy making investments that often can’t be done with other firms, such as cryptocurrency, real estate, precious metals, private equity and more. We help you diversify your portfolio with investments outside the traditional stocks, mutual funds and exchange-traded funds (ETFs).

2. Opening a Self-Directed IRA

Here’s a step-by-step guide you can follow to set up a self-directed IRA account:

- Complete the account application: You may only need 10 minutes to fill in a form with personal details like your birthdate, Social Security number, mailing address, contact information and an image of your photo ID.

- Fund your account: Fund your account by making direct contributions; rolling over funds from an established 401(k), IRA or other established tax-qualified account; or transferring your assets or funds from a previous provider to a new one of the same retirement account type.

- Start investing: You may now start instructing your custodian to invest your funds into the asset of your choice. To do so, you’ll fill out a direction of investment (DOI) form stating the specifics of your investment and delivery instructions.

3. Setting up an LLC for a Self-Directed IRA

Opening a limited liability company (LLC) for your self-directed IRA can help you gain tax advantages. You get these advantages when your IRA owns an LLC and allows you to access the business gains after your retirement. Here’s how you might set up and establish your IRA LLC in four steps:

- Consultation on account goals: Start by discussing your account goals and LLC investment plan with your custodian so they can help create a valuable account for this.

- Set up the LLC: Your self-directed IRA LLC facilitator may assist you in establishing an LLC for your account and writing an operating agreement.

- Invest in your LLC: You may then instruct your custodian to invest your retirement money in the LLC and provide the specifics of this plan.

- Open a checking account: Go to the bank and open a checking account in your LLC’s name so your IRA can invest in assets without custodian involvement.

Investment Options

You must understand your investment options and what techniques to implement to maintain your investments and funds.

Types of Investments Allowed

Self-directed IRAs allow you to invest in assets beyond traditional funds, stocks and bonds. Some alternative assets you might invest in include:

- Real estate

- Private stock

- Commodities

- Cryptocurrency

- Precious metals

- Crowdfunded assets

- Limited partnerships

Borrowing and lending in a self-directed IRA enable you to loan your IRA money to non-disqualified persons. An IRA can receive a certain amount of principal and interest if this is pre-agreed to, just like a bank would. One appealing feature of a self-directed IRA is that the IRA holder chooses who to lend to, the interest rate, the principal amount, length of the loan, payment amount and frequency and whether the loan is secured by collateral.

Investment Strategies

Two practices are worth implementing with most self-directed IRA investment options due to their complexity:

- Risk management: Perform due diligence by researching markets, financial reports and different scenarios to select an investment with fewer risks. It may help to seek additional guidance from experts.

- Diversification techniques: Rather than putting all your funds into one investment option, spread them across various investments to diversify your source of retirement funds.

Disqualified Persons and Transactions

Every IRA has a list of persons and entities that are considered disqualified to that IRA. IRS rules prohibit the IRA from dealing with these people and entities. Any transactions that do take place between an IRA and disqualified persons result in what’s called a Prohibited Transaction.

One of the easier ways someone can violate self-directed IRA rules is by not understanding who exactly is a disqualified person. According to the IRS, these people include the IRA owner’s parents, spouse, children and grandchildren. These people are excluded from benefitting from the IRA owner’s investments. For example, if the IRA owner’s adult child needs a home to rent, and the IRA owner has property in their IRA, their child cannot stay in that investment property.

Those disqualified persons to an IRA cannot buy or sell any asset from the plan nor make personal use of an asset. Disqualified persons cannot live in or rent IRA-owned real estate, nor can they provide “sweat equity” to that property.

Your IRA also cannot acquire life insurance or collectibles as assets. Some examples include:

- Any work of art

- Rugs or antiques

- Stamps or collectibles

- Any alcoholic beverages

Fees and Costs

When setting up a self-directed IRA, it’s essential to consider custodian charges and fee structures because they may include varying rates that might directly influence your investments.

Custodian Fees

Compare IRA fee schedules when looking for an ideal custodian:

- Contact multiple custodians: When looking around for custodians, ask what they charge to help ensure you get fair rates.

- Evaluate fee structure information: Custodians may offer tiered, percentage-based or flat fees. Opt for flat rates instead of percentage-based fees, which may vary based on the amount in your account.

- Compare the fee structure with your plan: Consider your investment plans while comparing fee structures, and choose one that is simple to understand and may maximize your returns.

Total Cost to Set up and Maintain a Self-Directed IRA

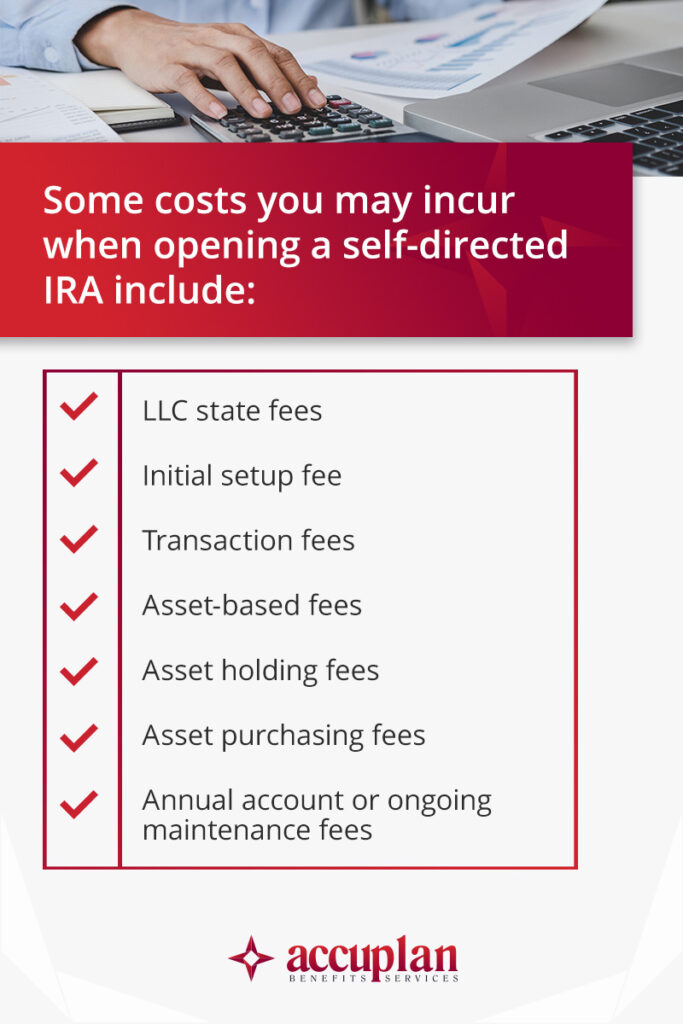

Some costs you may incur when opening a self-directed IRA include:

- LLC state fees

- Initial setup fee

- Transaction fees

- Asset-based fees

- Asset holding fees

- Asset purchasing fees

- Annual account or ongoing maintenance fees

Advantages and Disadvantages of Setting up a Self-Directed IRA

Benefits of setting up a self-directed IRA include:

- Greater investment flexibility: You may build a more diversified retirement portfolio of investments.

- Potential for higher returns: Being well-versed in certain asset types and industries and doing your research may help you tap into potentially more successful investments.

It’s also critical to consider the potential drawbacks of investing with a self-directed IRA:

- Management responsibilities: You are solely responsible for conducting research and making the right investment decisions. It is crucial to understand and remember IRS rules to avoid penalties.

- Higher fees: Your fees may depend on your investment type and custodian, so it may help to ensure you understand them before investing.

Organize a Self-Directed IRA With Accuplan Today

Investing in your retirement can be easily navigated — and even fun — so long as you have the right people working with and for you. We will keep your best interest at heart when you choose our team.

Learn where to start to open a self-directed IRA, and contact us for more information on requirements and limits. Create an account with us right now to begin choosing your investments.

You Might Also Like

Disclaimer: Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.